A quiet but important tax change took effect on January 1. If you use subcontractors, it affects how you do business. With most teams heading into their first monthly close of the new year, this is the right moment to update how you track subcontractor payments.

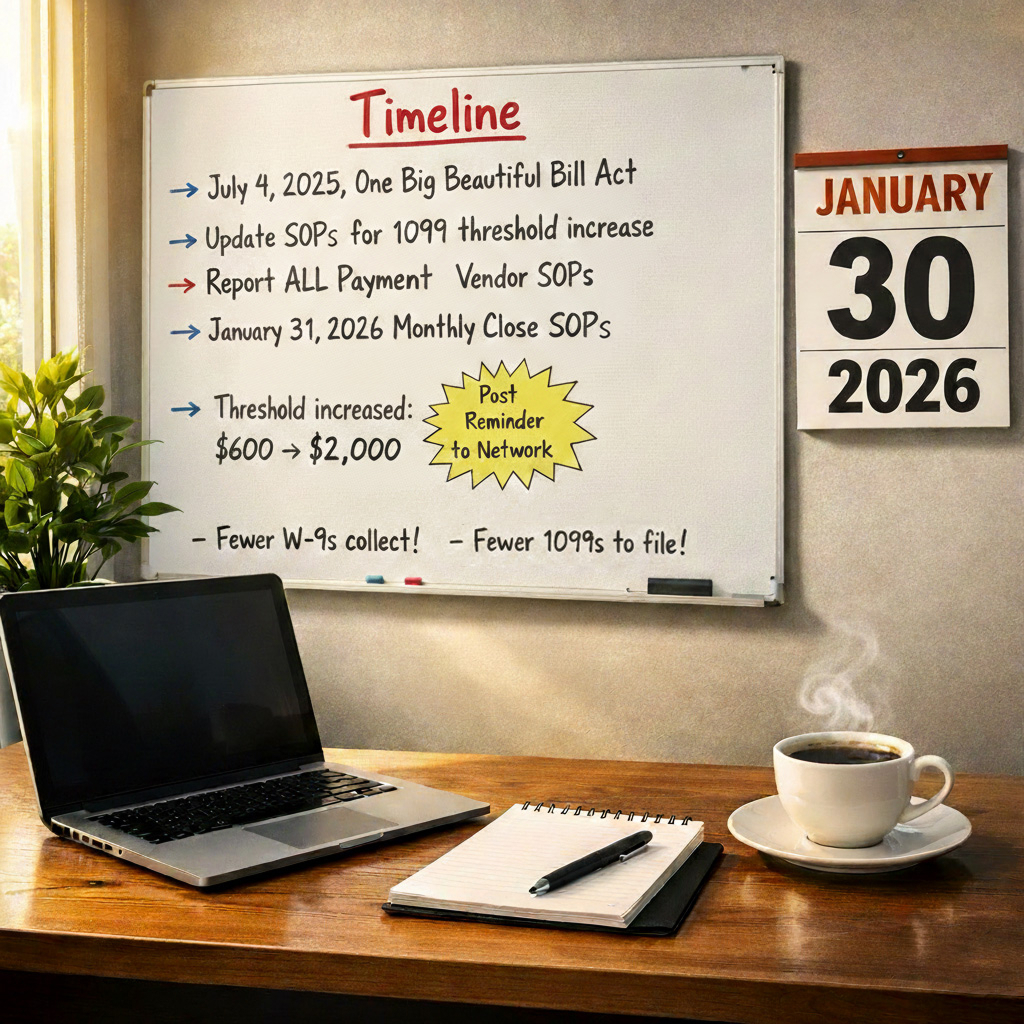

Buried inside the One Big Beautiful Bill Act is a major update to 1099 reporting rules. For construction and construction services companies that rely on short-term or one-off subcontractors, this change can materially reduce administrative work and tax-time headaches.

That’s only if you’re aware of it. If you don't have a dedicated CFO, there’s a good chance this flew under the radar.

The reality is you should already be adjusting how you work with subcontractors.

For years, the rule was simple (and painful): Pay a subcontractor more than $600 a year and you owe them a 1099.

Miss one, and the penalties add up quickly: $60 to $340 per form, plus $680 if the IRS determines the failure was intentional disregard.

That’s real money for companies managing dozens of subcontractors throughout the year.

Good news: As of January 1, the threshold increases to $2,000. In practical terms, if you pay a subcontractor $1,999 or less, you are no longer required to issue a 1099-NEC.

This change was discussed in the news last summer while the bill was being considered, but now is the moment it matters: it took effect January 1, 2026. As you head into your first monthly close of the new year, you should update your subcontractor workflow now.

This isn’t just a tax form update. It affects:

- How you track subcontractor spend during the year

- How much year-end cleanup you have to do

- Your exposure to IRS penalties

- Whether your accounting systems can adapt

If you want help setting this up the right way, I’m happy to help. Book a complimentary consultation at CounselFi and I’ll tell you how this will impact your business.

What the new 1099 law means for businesses that use subcontractors">

What the new 1099 law means for businesses that use subcontractors">